Overview

Channel banking is a set of formats & channels made available by the bank to its customers so that the customers can access the various services (Collections and Payments) offered by the bank themselves without the assistance of a bank officer using a variety of modes.

The banks offer various formats & channels to its customer to access its backend services. Some of these formats are:

- RTGS/NEFT

- ECS

- IMPS

- SWIFT

- SMS Banking

- Internet Banking and

- ATM Banking

These formats use industry standard messaging protocols such as ISO 8583.

These formats use various modes to make such services available to the bank’s customers. Some of these modes are:

- Internet

- Host to Host

- ATM

- Hand Held

- Kiosk

- SMS

- IVR and

- Branch Banking

The middleware connects these formats with the various channels and the backend services of the bank.

This document explains the module architecture, various formats & channels, modes, middleware features and the interaction with the various backend services offered by the bank.

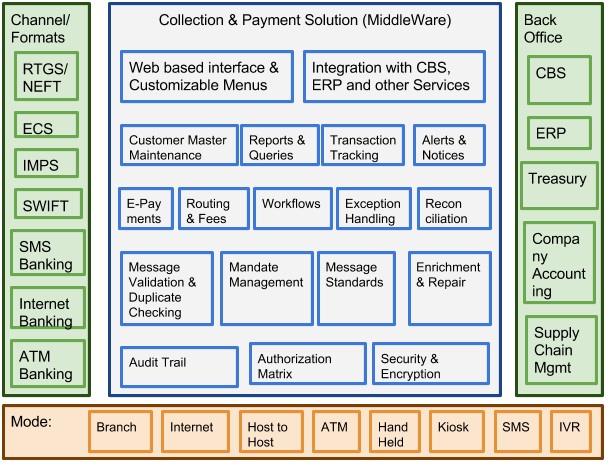

Comprehensive Channel Banking Module Architecture

A pictorial summarized architecture of comprehensive channel banking is shown below. The channels/ formats connect to the Collection & Payment solution via the various channels. The collection and payment solution is in turn connected to the Back Office.

The systems can be deployed either on a Public Cloud, Private Cloud or as a non internet based solution.

Mindmill provides the full cloud based solution for all the components shown above across the world using its servers in its Tier III data centers with DR sites.

Operations management is also available at all levels with trained manpower.

Channels/Format Details

Mindmill provides the following Channels / Formats for a user to access banking services:

- RTGS/NEFT

- ECS

- IMPS

- SWIFT

- SMS Banking

- Internet Banking and

- ATM Switch

Details for these are given below:

RTGS/NEFT

The acronym 'RTGS' stands for Real Time Gross Settlement, which can be defined as the continuous (real-time) settlement of funds transfers individually on an order by order basis (without netting). 'Real Time' means the processing of instructions at the time they are received rather than at some later time; 'Gross Settlement' means the settlement of funds transfer instructions occurs individually (on an instruction by instruction basis). Considering that the funds settlement takes place in the books of the Reserve Bank of India, the payments are final and irrevocable

NEFT (National Electronic Funds Transfer) is an electronic fund transfer system that operates on a Deferred Net Settlement (DNS) basis which settles transactions in batches. In DNS, the settlement takes place with all transactions received till the particular cut-off time. These transactions are netted (payable and receivables) in NEFT whereas in RTGS the transactions are settled individually.

RTGS is done instantaneously and NEFT is done on an interval basis typically hourly.

RTGS is typically done if the amount is more than a certain limit and NEFT is used if the amount is less than a certain limit.

ECS

ECS is an electronic mode of payment / receipt for transactions that are repetitive and periodic in nature. ECS is used by institutions for making bulk payment of amounts towards distribution of dividend, interest, salary, pension, etc., or for bulk collection of amounts towards telephone / electricity / water dues, cess / tax collections, loan installment repayments, periodic investments in mutual funds, insurance premium etc. Essentially, ECS facilitates bulk transfer of monies from one bank account to many bank accounts or vice versa

IMPS

IMPS offers an instant, 24X7, interbank electronic fund transfer service through mobile phones. IMPS facilitate customers to use mobile instruments as a channel for accessing their bank accounts and put high interbank fund transfers in a secured manner with immediate confirmation features

SWIFT

SWIFT is the Society for Worldwide Interbank Financial Telecommunication, a member-owned cooperative through which the financial world conducts its business operations with speed, certainty and confidence. More than 10,500 banking organisations, securities institutions and corporate customers in 215 countries trust us every day to exchange millions of standardised financial messages.

SMS Banking

A range of SMS formats have been created which allow users to transact on their accounts with the bank by sending these messages as SMS to a prespecified number. The transactions are secured by using a PIN number which is only known to the bank customer.

Internet Banking

A range of features are made available on Bank’s Internet site which allow the users to transact on their accounts with the bank using the Bank’s web site made available to its customers.

ATM Banking (Switch)

A range of ATM feature formats have been created which allow users to transact on their accounts with the bank by using the Bank’s ATMs or its correspondent Bank’s ATMs. The transactions are secured by using a PIN number which is only known to the bank customer

Modes

The various channels are made available on a variety of modes (based on applicability) such as:

- Branch Banking

- Internet

- Host to Host

- ATMs

- Cash Dispensers

- Hand Held Devices

- Kiosks

- SMS

- IVR and

- Kiosk Passbook Printersra

Branch

These are regular branches of the banks where a customer can walk in and get their transactions done by the officers. The officers use a computer as the front end which is connected to the bank’s CBS servers via private/public cloud.

Internet

This is the internet site of the bank which is accessible to its customers. The transactions are secured by using a login name and password which is only known to the bank customer. These transactions are further secured by using OTP which is a two step authentication process and sent to the user’s registered cell phone number.

Host to Host

This is a system where two banks communicate between themselves for doing various customer transactions by having dedicated servers (Hosts) on either end which are in a highly secure environment and connected to each other using a highly secure WAN. Typically this arrangement is used between sponsor banks and sponsored banks for formats such as RTGS/NEFT.

ATM

These are machines which are ubiquitous and provide for cash dispensing, cash deposit and other transactions.

Cash Dispenser

These are machines which are used for cash dispensing only and connected to bank branches. The tellers do the transaction and give a token to the customers. The customers take the token and put it in the cash dispenser to withdraw money.

Hand Held Devices (Micro ATM)

These are devices carried by agents of the banks from one place to another for doing transactions in remote areas. The devices are loaded every morning with the customer data and agent records the various transactions in the machine during the day. In the eventing the agent comes back to the branch and uploads the recorded transactions to the CBS

Kiosks

These are stand alone machines which allow the customer to transact on their accounts with the banks without the need of the bank officer. The transactions are secured using a customer login and password which are only known to the customer.

SMS

This is the medium used by SMS banking and IMPS by the banks to accept the transaction requests of the customer and for sending them confirmation for such transactions as well as for informing the customers for important upcoming events such as loan repayment dates etc.

IVR

This is a medium used by banks to allows customers to call into the bank systems (typically in a call center setup) where their actions are driven by an interactive voice. On entering the right sequence along with the account number and TPIN the system responds with the information. The customer can access a human officer by entering a prespecified number at the right time.

Kiosk Passbook Printer

These are stand alone machines situated in a bank branch which allow the customer to walk up and get their passbooks printed with the latest account transactions.

Collection & Payment Solution (MiddleWare)

This module is used for connecting the various channels to the backend services via the various modes mentioned above. This module is presented either in forms of web based interface to the branch officers or in form of validations and/or automated solution as part of the collection & payment process.

The various components are detailed below:

Web based interface & Customizable Menus

A web based interface is provided to allow banks to customize the collection and payment solution as per their needs and their parameters.

Integration with CBS, ERP and other Back Office Services

The solution takes customer requests in various formats over different channels and posts them to the back office services such as CBS, ERP et cetera.

Customer Master Maintenance

The system has a single customer master where the customer details such as cell phone number and login names are stored. This has a web based interface which the bank can use to access this. The IPIN and TPIN can be printed on special stationery which prevents anyone to see the same unless the perforation is compromised.

Reports & Queries

Various reports and queries are available to monitor the system.

Transaction Tracking

All transactions made via this system can be tracked easily using the web based screens provided with the system.

Alerts & Notices

The system allows email and sms based alerts and notices which can be preconfigured.

E-Payments (Bill Payments)

Electronic payments to various vendors can be made using this system. Vendors can be registered and the pending bills for various customers can be uploaded using a web enabled interface.

Routing & Fees

The routing of various services such as RTGS etc can be configured and various fee that the banks want to charge to the sponsored bank and the end customers can be configured. The same is automatically deducted from the customer payments.

Workflows

Various workflows such as CREATE-VERIFY-ENABLE are available in the system to allow the banks to work as per their procedures.

Exception Handling

Proper exception handling in various situations is taking care of and appropriately handled.

Reconciliation

Reconciliation between various banks involved in the transactions is done automatically and reports are available to show the same.

Message Validation & Duplicate Checking

All messages are validated for syntax and semantic checking. Duplicate message handling is done appropriately.

Mandate Management

Customer mandates (Registered Cell Numbers, IPIN, TPIN, etc) are maintained and each request is validated against it.

Message Standards

System uses standard message formats such as ISO 8583, SWIFT and Central Bank mandated formats such as ECS.

Enrichment & Repair

Messages which are incomplete are repaired using standard algorithms if they can be repaired before rejecting them.

Audit Trail

An audit trail of different transactions is maintained.

Authorization Matrix

The bank officers are authorized to perform various functions using roles and rights matrix which is maintained by the bank admin.

Security & Encryption

The entire system uses security and encryption system using Industry standard algorithms such as RSA, 3DES and MD5 besides MACID based access to the system.

Other Interfaces

This system also interfaces with modules such as Card Management System and Interfaces with other IIIrd party solutions to allow transactions with back end services such as CBS.

Next Steps

The next few steps are:

- Call Mindmill to do a demo of its unique “All Systems Integrated Single Software” to convince you that this is actually possible . Mindmill can also show the existing working servers which are hosting this solution for existing clients. Further Mindmill can give references of existing clients who are using this system effectively . If you desire Mindmill can arrange a site visit for you to see this in a live environment.

- Once you have satisfied yourself that this concept is actually possible, Mindmill will conduct a study of your existing system to identify all the functionality required by you.

- BankMill will then be configured using parameters to suit your requirements. Any custom requirement can be added.

- Finally data will be migrated to BankMill,

- Your users will be trained using online training material available on the cloud

- Your organization will at this stage become live in BankMill TM.

- Make your organization start saving large amount of money and get real customer and employee delight today besides feeling the bliss of working in a well organized structured single software and single server environment.