Overview

- BankMill Mobile App for Bank’s Customers (also called ePassbook)

- BankMill Mobile App for Bank’s Agents (Agent Banking)

- All apps have a modern colorful look and feel to make banking a fun experience for the App users.

Mobile App for Customers

- Select Account to Transact

- Get Account Balance

- Update Passbook

- Account Statement

- Transfer Funds

- General Features given in this document itself but in a different section.

Update Passbook

Account Statement

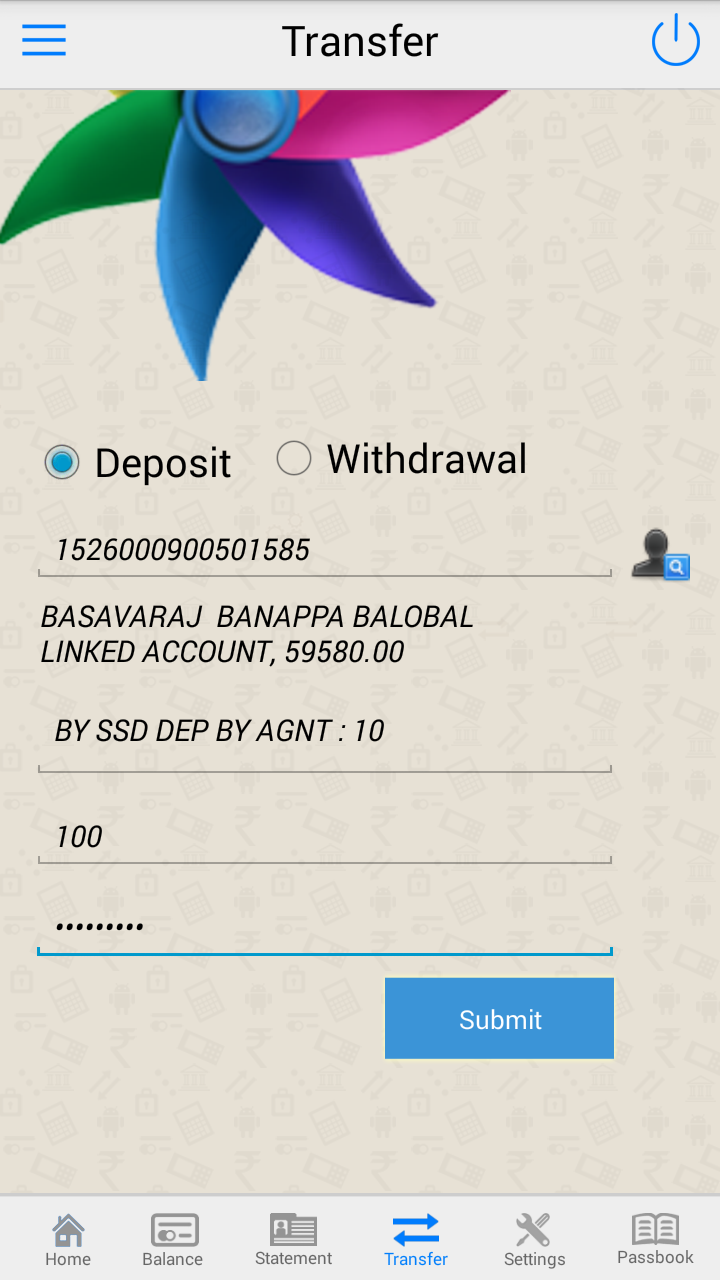

Mobile App for Bank’s Agents (Agent Banking)

- Deposit Money

- Get Agent’s Account Balance

- Withdraw Money (Optional and can be disabled at the configuration level)

- In addition, the agent can view all the transactions done by him for his customers for a specified period

- Online Mode

- Offline Mode

General Features Across all Apps

Registration

Sign In

Change Password

Benefits

Benefits to Banks

Benefits To Bank's Customers

- Customers feel self-reliant and do not have to go to the bank branches to do normal banking. Most of the work can be done by the customers making them feel empowered.

- Benefits Specific to Agent Banking

- Time: The bank and the agent have the latest updated account details at all times when the agent is online.

- Effort: Currently agents have to visit the bank with their device each day to upload the entered data and download the customer information. With this app they will not need to visit the bank each day. They will be able to upload the data from anywhere just by being online and download the latest customer details online.

- Money: Proprietary agent banking devices are very expensive. This app runs on regular android phones . Nowadays almost everyone has an android phone . These phones are cheaper than specialized agent banking devices. if the bank gets a new agent the bank will not have to buy these proprietary expensive machines

- Image: It gives a nice image that your bank is a modern bank aware about the latest technology using smartphones for banking. The app looks smarter than the other bulky devices

- At Least 20% to 30% Increase in Agent Daily Collection

Comparison (Legacy machines / Manual with BankMill Mobile App.)

|

Features |

Pigmy (Legacy) Machine / Manual |

BankMill Mobile Apps for Agent |

|

Setup within minutes |

Not Available |

Available |

|

No Daily Visits required to Branch |

Not Available |

Available |

|

Both Collection and Withdrawal Supported |

Not Available |

Available |

|

Instant Credit to Customer Account in CBS |

Not Available |

Available |

|

SMS based Receipt to Customer |

Not Available |

Available |

|

Both Online and Offline mode Supported |

Not Available |

Available |

|

More Secured for Banks- Limit Based Collection and Withdrawal for Agent |

Not Available |

Available |

|

Ramp-up Agents from 0 to 100 with in minutes |

Not Available |

Available |

|

Cost Effective for Bank |

Not Available |

Available |

|

Easy Tracking of Agents |

Not Available |

Available |

|

Online Statement for Agents for Cross Checking |

Not Available |

Available |

|

Option to Collect from other Agent’s Customer too |

Not Available |

Available |

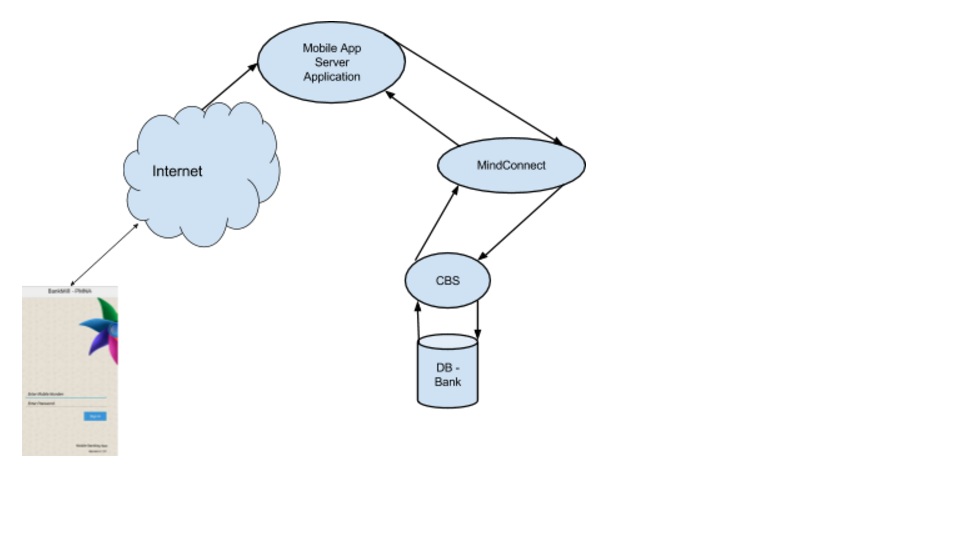

Solution Architecture